The most frequent reason for business failure is poor management of finances and accounting. Therefore, it would be better if you take professional guidance regarding financial accounting. Giving your work to an experienced expert could be your best business decision ever made yet.

Many people don’t start a business because they don’t want to deal with demanding jobs like bookkeeping and complex responsibilities like accounting. But you also don’t want to fail at keeping track of numbers accurately. An experienced professional with knowledge of your industry can easily identify those areas of your business with room for improvement. This also gives you more space and resources for core business operations.

According to a Deloitte 2016 survey, more than 30% of companies plan on handing over their complete finance work to outside professionals.

External Accounting Firms Benefiting Businesses

Keeping in mind the increasing requirement of outside professional service firms, here are some points which explain the benefits of hiring external business process management companies for finance and accounting services.

More attention toward finance department

The financial department gets less attention than others when it is handled in-house. The reason being core revenue generation must be the key focus of any enterprise. But when you hand over your financial department to professional service firms, the experts give utmost priority to your business accounting as that is their core operation and area of expertise. Therefore, your financial department gets the same level of attention as your core operation does.

Access to experts from different fields

External financial service firms have more exposure and expertise than your in-house team as they specialize in diverse finance and accounting areas. Therefore, you get access to experts from various fields such as regulation, taxation, accounting, etc., to address your needs better, ensuring you get customized solutions as per your need.

Frees up time for core activities

Giving your finance and accounting work to business process management firms allows you to concentrate on increasing your revenue rather than worrying about the complexities and tiresomeness of managing finances and accounting. You just have to provide the detail of the accounting processes and system to the professionals who will attentively focus on delivering quality services.

Easy scalability

Finance and accounting departments experience several highs and lows throughout the year in order to meet quarterly and annual tax filings and reporting. Thus having an in-house finance team can be an issue when the need to increase scalability arises. However, with external experts at your side, you don’t have to encounter this issue as you can hire extra working staff at reasonable prices.

Reduced chances of error

Handing over your finance work to outside firms provides you with multiple slabs of review and quality check built into their procedure, catching errors and providing precise information. On the contrary, by the time an in-house financial department discovers a mistake, it can be terribly expensive or too late to rectify.

Handling regulatory changes

With the evolving industries, the required standard compliances are changing at a rapid pace. The business owner can suffer difficulty because of these ever-changing compliance regulations, especially now as there are so many of them. But a business process management firm will have experienced professionals who stay up to date with all kinds of regulations to ensure there is no compliance issue. Therefore, you can effortlessly handle regulatory changes as you have experts taking care of all your finance and accounting operations.

Effective utilization of resources

By handing over your work to external business process management firms, you can save a lot of money on your operations. For example, suppose you have been planning to enter into a new segment or invest more money in marketing or developing a product. In that case, you can use the funds which you have saved.

No scope of penalties

The vast number of red tape and forms needed to be submitted to HMRC each year can cause distress. Not to forget how tedious it is for company directors, even with the availability of in-house staff. Also, there are multiple risks involved with the finances of a business, like how employees are handling company money or even instances of money laundering. But by placing your finances with a third person by giving up your financial work to an external firm of accountants and financial experts, your internal involvement decreases. This keeps your financial information shielded. You are safe as you provide a clean audit trail and have minimized the risk of any internal fraud.

Cash flow management

Cash flow is a crucial decider of whether a company will stay in business or not. Entrusting outside professionals who have expertise in financial management can significantly increase efficiency, carry out all invoices timely, and effectively chase any debtor. The level of knowledge and skills these companies have helps in providing optimum advice on managing important purchases and making investments so that they align with your company’s estimated cash flow.

Pursuit of Growth

One of the key reasons why more and more companies these days are opting for external financial service firms apart from cost-effectiveness is to attain growth. Effective financial management can make or break a company as finance plays a centric role in all business aspects. Experienced accountants provide better advice regarding bookkeeping or payroll, taxes and can investigate your spreadsheets from a different perspective, which reasons out the numbers.

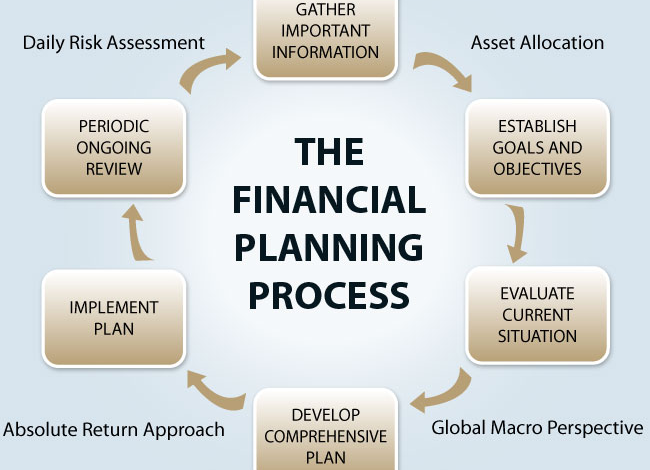

Confident execution

It is impossible for business owners and entrepreneurs to monitor in what direction their firm is navigating without solid financial management guidance. Authentic visualizations and structures are required to track budgets and forecast or to identify simple mistakes by workers. With accurate financial reporting, you can confidently execute strategies.

Access to the latest technology at affordable prices-

Modern technological advancements in finance and accounting may compel companies to invest a massive amount in enhancing their hardware and software. But this can prove to be an expensive decision as technology is evolving rapidly, so firms may again have to spend money to purchase the latest equipment. But when you work with BPM firms to get your finance work done, you acquire access to cloud-based platforms by paying only a fragment of the original cost. Prominent service providers provide access to such solutions for all of their clients at affordable costs. This makes sure you get accurate financial insights at the minimum price.

Conclusion

Your dedication to your business doesn’t mean that you can’t delegate specific jobs to the experts. Even as a businessman or entrepreneur, you have the same amount of time in the day like any other person, but the obligations are double. Seeking assistance in the non-competitive verticals of your business can save up valuable time so you can concentrate on growing your business.

From small to big, companies of all sizes can leverage by handing over their finance functions in numerous ways. Seeking assistance in finance and accounting increases the efficiency of the business by removing the need to supervise in-house accounting staff.

Making your business successful is no child’s play. But for the few bold who take this road are met with many obstructions. You may think that these obstacles must be unknown or not visible easily. But, instead, they are prevalent and easily solvable, like failing to ask for assistance. So, in order to assure smooth function your finance department, consider contacting an external service provider. You will observe the benefits on your own in a short span of time.